Cash Flow Doesn’t Just Happen - You Drive It

Let’s be honest: Most leadership teams know their P&L. They might glance at the balance sheet, but when it comes to cash flow, they’re running on hope and instinct.

Here’s the truth at the heart of Data: Harness Your Numbers to Go from Uncertain to Unstoppable: Cash isn’t just a result—it’s something you can actively drive.

That’s why the Cash Flow Drivers Exercise—a practical framework from The Data Book helps leadership teams pinpoint and influence the specific activities in their business that generate more cash and more profit.

Whether you’re a for-profit or nonprofit, growing fast or stabilizing margins—this exercise will help you and your team think differently, act intentionally, and move from reactive to proactive when it comes to money.

Let’s break it down step-by-step.

Step 1: Set the Context

Start by drawing the Cash Driver “Spider”—a circle with 6–10 “spokes” extending from it. Each spoke will eventually represent a key cash or profit driver in your business.Facilitate a short conversation about why cash and profitability matter in every business:

- Cash creates flexibility and peace of mind.

- Profit fuels growth, innovation, and sustainability.

- Even nonprofits need margin to fund their mission.

Step 2: Brainstorm Potential Drivers

Give your team 5 quiet minutes to reflect on this prompt:“Where do we believe cash, profit, or margin is created (or lost) in our business?”

Pull ideas from your own experience, or reference examples from EOS tools like:

- Sales conversion metrics

- Inventory turns

- Price realization

- Labor utilization

- A/R and A/P timing

- Rework, waste, or returns

Step 3: Assign Accountability

Here’s where this exercise becomes actionable.

For each driver, ask: “Who is ultimately accountable for improving this?” and write one person’s name next to each one. Not a department. Not a team. A single owner. This person is now responsible for watching, reporting on, and improving that driver over time.

Step 4: Set the Improvement Goal

Now that each driver has an owner, it’s time to add a clear improvement goal.This could be:

- “Increase gross margin from 42% to 45%”

- “Improve collection speed by 10 days”

- “Reduce rework to <2% of total orders”

Each goal should be achievable 80% of the time, stretch the business in the right way, and reflect an intentional focus.

Once you’ve completed this step, your team now has a map of where cash and profit live in your business—with names and targets attached.

Step 5: Create Action and Momentum

With your drivers, owners, and goals in place, now it’s time to move.Set quarterly Rocks and weekly To-Do’s to start working on each driver

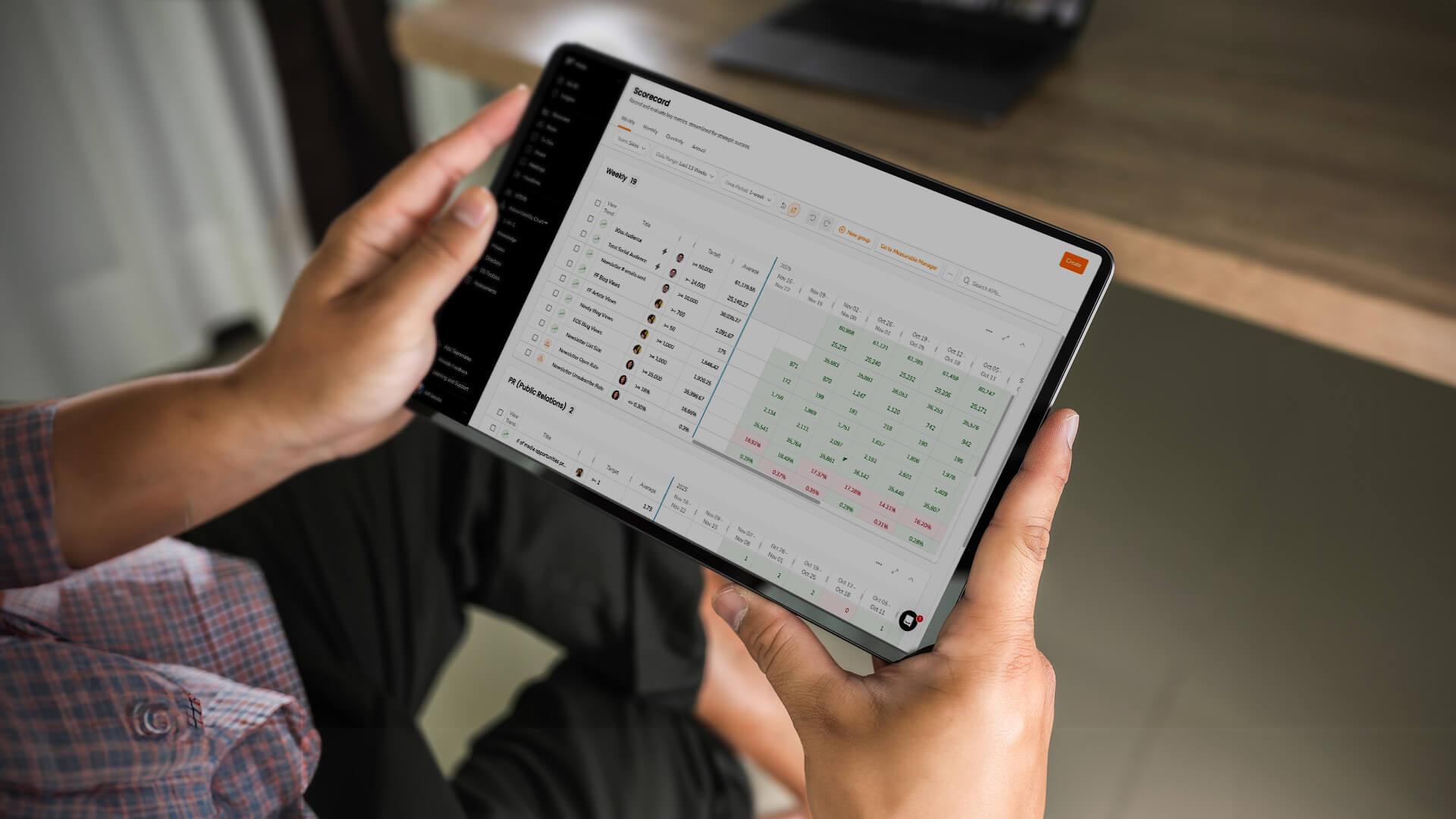

Incorporate drivers into your Scorecard, V/TO, or budgeting

Build a branded model or framework to reinforce the importance

This gives your team language and structure to rally around—and drives cultural ownership over results.

Step 6: Repeat the Exercise

This isn’t a one-time event. Schedule a regular time—at least annually—to come back to your Cash Flow Drivers:- What’s improved?

- What’s stalled?

- What new opportunities have emerged?

Cash Confidence Starts with Cash Clarity

You don’t need to be a finance expert to drive more cash into your business. You just need the right framework, a little focused time, and the willingness to think differently.Want to take this even deeper and work through the cash flow drivers for your specific business? Register for The Data Driven Leader Workshop, where the authors of the Data book will expertly walk teams through this exact Cash Flow Drivers exercise—turning ambiguity into action and wishful thinking into real financial traction.

Guaranteed to find at least 25x value or your money back! For more information visit: www.unstoppable-biz.com.

If you’re ready to:

- Stop wondering where the cash is going

- Empower your team to act on what matters

- And build a business that’s sustainable, profitable, and scalable...

.jpg)